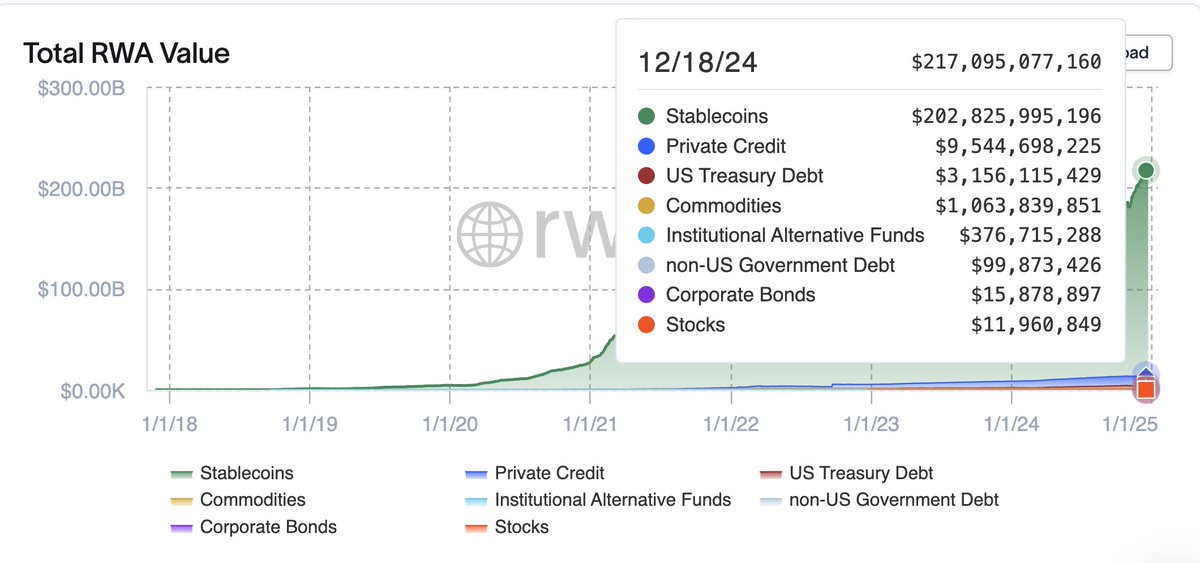

The growth of RWA (Real World Assets) in 2024 reveals immense potential. Let’s break it down.

Conclusive Thoughts First

- RWA covers a broad range of assets, but the most promising remain stablecoins, U.S. treasuries, and private credit.

- The stablecoin market is dominated by three key players and is likely to stay that way.

- U.S. treasury protocols mainly differ in fees and accessibility for retail investors, though reputation remains a critical factor.

- A reduction in U.S. Fed interest rates will lower treasury yields, diminishing the incentive to hold new treasuries.

- Despite this, U.S. treasury protocols continue to attract significant attention and funding.

- Private credit models rely on attracting creditworthy businesses to minimize default rates.

- Improving illiquidity and default repayment issues could position private credit as a key growth area within RWA.

So, what is RWAs?

RWAs (Real World Assets) refers to tokenizing real-world items like stablecoins, US treasuries, and private credit to bring them on-chain. This bridges traditional finance and decentralized finance, unlocking new opportunities for liquidity and accessibility.

Why Do RWAs Matter?

With a total value locked increasing from $2B to $9B(excluding the stablecoin market) , merely a fraction of TradFi’s total assets, the growth potential for RWA is immense.

Tokenized assets like bonds, real estate, gold, and lending are just the beginning. Tokenization unlocks a global asset pool, democratizes investor access, and creates new revenue streams for issuers and intermediaries, paving the way for transformative opportunities in the financial ecosystem.

How does Blockchain Improve Traditional RWAs?

RWAs unlock vast untapped markets for tokenization, offering:

- Increased Liquidity: Traditional finance limits trading to set hours, but tokenized assets enable 24/7 trading, ensuring seamless transactions.

- Fractional Ownership: Invest in high-value assets like real estate with fractional ownership.

- Transparency: Auditing and token issuance post-asset custody ensure greater security and investor confidence.

Challenges Facing RWAs

While RWA offers a large market size and stable value, it still struggles with key challenges like low liquidity, limited transparency, and trading inefficiencies:

- Regulatory Hurdles — Adhering to laws and regulations tied to tangible assets can be complex, with the risk of legal issues post-launch.

- KYC Requirements — Both issuers and investors must undergo KYC to comply with AML/CFT standards, raising centralization concerns.

- Custody & Security — Strong security measures are essential to ensure collateralized assets are safe and not misused.

- Default Risks — Private credit within RWA carries significant default risk, unlike DeFi loans, which lenders can manage through overcollateralization.

- Key Categories Break Down

(Source: tokenizedassetcoalition.com)

- Stablecoins

The total MC of stablecoins reached $203.38B by the end of 2024. Held by 139.51M accounts globally. The majority of stablecoins are dominated by USDT and USDC, backed by USD, U.S. Treasury bills, and cash equivalents etc. While the market is smaller, algorithmic stablecoins, over-collateralized stablecoins, and tangible asset-backed stablecoins also play a role in the ecosystem.

2. Private Credit

The total value of active loans stands at $9.49B, with a cumulative loan value of $16.23B. Unlike the over-collateralized lending structure in DeFi, private credit protocols provide collateralized lending. Deliver yields comparable to, or even better than, those in TradFi and, in some cases, DeFi. Make borrowing easier for businesses while offering lenders better rates compared to traditional banks. Act as intermediaries, the protocols connect external companies seeking funds with crypto lenders.

Pros:

- Senior Pool APY offers higher yields than many DeFi and UST options.

- Loan counterparties are typically vetted, well-established companies.

Cons:

- Repayment issues from counterparties can lead to defaults, impacting yields and causing potential losses.

- Low liquidity makes exiting private credit pools challenging.

- Default management by junior pool investors lacks transparency for general users.

3. Treasury/bonds

The total value of treasury and bonds are 116.45B. U.S. T-Bills dominate the treasury market, backed by the U.S. government’s guarantee of interest and principal repayment. Bonds from other countries exist but are less traded and less liquid. Gained popularity in 2022 and early 2023 due to rising U.S. Fed interest rates. The high-interest environment, coupled with the crypto bear market, offered competitive yields.

4. Commodities

The MC of commodities is $1.05B. Monthly Transfer Volume of commodities is $263.34M. Mostly dominated by gold, with other types like oil, metals, and uranium also included.

Pros:

- Enables on-chain access to gold products.

Cons:

- Apart from gold, other on-chain commodities are not widely adopted by traders.

- Low liquidity and trading volume make some commodities susceptible to price manipulation.

5. Real Estate

Pros:

- Allows smaller investors access to high-value assets via blockchain.

Cons:

- Most platforms have high entry barriers, like Propy as a listing platform or Tangible requiring pledged property.

- Low liquidity limits trading opportunities for tokenized RWAs.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。